About

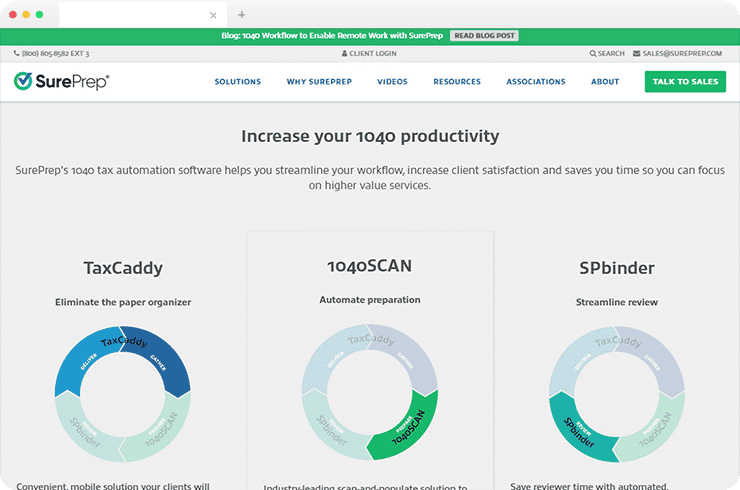

Leading in 1040 tax automation for CPA firms, the client provides innovative, comprehensive, and productive tax automation solutions that include scan and populate with an optional OCR verification service, outsourcing and a two-time award-winning mobile solution that eliminates the paper organizer. Their solutions are utilized by nearly 20,000 tax professionals at CPA firms large and small, ranging across the spectrum from Big 4 firms to sole practitioners.

Project Highlights

The requirement was of.Net MVC-based application development and having the proper workflow that follows the process of income tax filing. Creating documents in format Income Tax, CCH third-party software in a bind with the US government, Filling the form sending data to CCH and pulling back, etc. The building of an application based on.Net MVC was required, as was the provision of an appropriate workflow that tracks the steps involved in the process of submitting income taxes. Brainers created papers in the format of Income Tax, CCH third-party software being in a bind with the United States government, filling out the form, sending data to CCH, and retrieving data back, etc.

The Challenges

- Detect Discrepancies or Errors:The process of verifying the accuracy of the form by cross-referencing the information with other databases and systems was time consuming.

- Complex View Structure:The client wanted a simplified design for the front end to enhance the user experience.

- Tax Calculator:Calculate taxes owed or refund amount due for the current tax year.

- Automated Cloud Allocation:It was challenging for the client to manage all resources offline and on-premise base.

Tech Stack

.Net core

Angular

Azure cloud

jQuery

Microsoft SQL Server

Python

Web API

Result

Automate Detection

Automate the process of verifying the accuracy of the form by cross-referencing the information with other databases and systems. Enabled Detection of any potential errors or discrepancies in the data provided by the customer.Increased Client Satisfaction

The client improved customer satisfaction by providing tax info. The new system's adaptable architecture meets the customer's current and future business needs. We built a web-based stateless multi-tier system and added to its predecessors' features.Automate the tax calculation

This eliminated the need for manual calculations and provides an accurate, up-to-date view of the individual's total tax liability.The application also provides a comprehensive overview of their taxes due, allowing users to make informed decisions about their taxes.Effective Load Management

Our team provided the appropriate level of automation with Cloud computing, which assisted the client in effectively managing the required level of burden.