The pace at which the financial sector is transforming is remarkable. Traditional banks with physical branches are being rapidly overshadowed by digital-first experiences that offer personalization, speed, and predictive intelligence, all driven by Artificial Intelligence (AI).

Today, AI-powered fintech platforms like Revolut, Chime, and N26 are redefining how consumers manage money with instant credit scoring, budgeting insights, and smart savings recommendations.

Even legacy institutions like JPMorgan Chase and Goldman Sachs are adopting AI-driven tools to automate risk assessment, detect fraud in real-time, and deliver hyper-personalized financial advice. This shift has turned AI from a competitive advantage into the core engine powering the next generation of digital banking.

They’re changing the way banks handle risk assessment and interact with customers. The message for banks and financial institutions is clear: either embrace these innovations or risk being left behind.

This blog dives into how AI is reshaping digital banking, some standout examples, the technologies involved, and strategies for rolling out the next wave of financial applications.

The Imperative for Transformation in Digital Banking

One big challenge for traditional financial institutions is dealing with old infrastructure and manual processes. Such an approach can lead to uninspiring, one-size-fits-all customer service. These inefficiencies leave much room for agile fintech startups, which cleverly use AI to step in and grab the spotlight.

The pressure to modernize is huge, especially with customers expecting seamless, mobile-first services like they experience with their favorite e-commerce or streaming platforms. Here are a few areas where traditional banks are falling behind:

Fragmented Customer Experience

Banks often have multiple channels, including web, app, and physical branches, which can create a disjointed customer experience. Customers can be frustrated when they can’t access consistent service or data.

Slow Risk Management

Relying on outdated data and manual reviews slows down loan decisions and can even lead to missed chances to detect fraud early on.

High Operational Costs

Manual compliance checks and managing prominent physical locations can significantly reduce profits.

According to a McKinsey & Company study, if banks adopt AI, their annual value could boost by an estimated $200 billion to $340 billion. That’s a solid incentive to integrate AI into their operations!

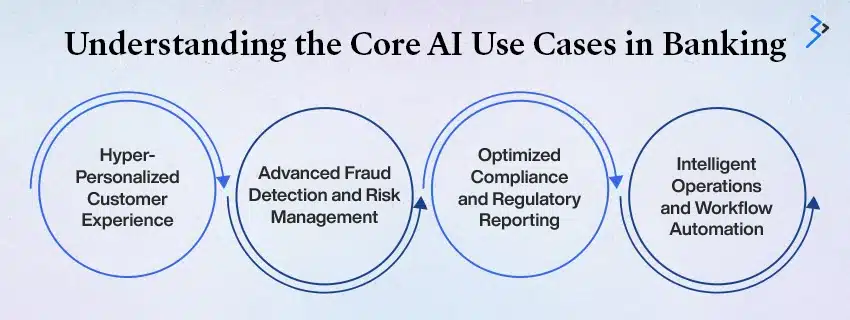

Understanding the Core AI Use Cases in Banking

The power of AI-driven fintech apps lies in their ability to process massive datasets instantaneously, extracting insights that are impossible for human analysts alone. This capability translates into transformative use cases across the entire value chain of digital banking.

1. Hyper-Personalized Customer Experience (CX)

AI moves banking from generic product pushes to deeply personal recommendations, making every customer feel valued.

- Virtual Assistants and Chatbots: According to IBM, chatbots can resolve up to 80% of routine customer inquiries, thereby freeing human agents to focus on more complex problem-solving tasks.

- Personalized Financial Management: AI-driven fintech apps use algorithms to analyze spending, income, and savings, providing tailored budget advice. They also predict potential cash flow gaps and suggest optimal investment pathways or savings products in real time. This level of intimacy builds long-term loyalty.

2. Advanced Fraud Detection and Risk Management

AI is essential for protecting banks and customers against increasingly sophisticated financial threats.

- Real-Time Transaction Monitoring: Machine Learning (ML) algorithms continuously monitor billions of transactions. They establish baseline behavioral models for each customer and flag anomalies, such as unusual purchase locations or amounts, with far greater accuracy than traditional rule-based systems.

- Credit Scoring and Loan Underwriting: AI models incorporate non-traditional data (like social media data, if permissible, or utility payments) alongside credit history to provide a more holistic and accurate risk assessment.

Accelerating loan approvals while reducing decision bias improves customer satisfaction and can lower financial risk. According to a study by Deloitte, institutions that streamlined their credit processes and minimized systemic bias experienced a 20–30% drop in default rates across specific portfolios.

3. Optimized Compliance and Regulatory Reporting

Regulatory compliance (RegTech) is a massive operational burden. AI automates and streamlines adherence to ever-changing global rules.

- Anti-Money Laundering (AML) and Know Your Customer (KYC): AI can quickly scan and verify identity documents, process background checks, and monitor large-scale transaction networks for suspicious patterns, dramatically reducing the time and cost associated with manual review.

- Regulatory Analysis: Natural Language Processing (NLP) models can ingest new regulatory documents, summarize key changes, and map them directly to existing bank policies, ensuring proactive compliance updates.

4. Intelligent Operations and Workflow Automation

AI simplifies the bank’s internal workings, reducing human involvement in repetitive, high-volume tasks.

- Robotic Process Automation (RPA): RPA bots handle routine data entry, report generation, and system reconciliation across various departments, maximizing internal efficiency.

- Predictive Maintenance: AI models can predict when core banking systems or hardware might fail, letting IT teams perform maintenance proactively and minimize downtime, ensuring continuous service delivery.

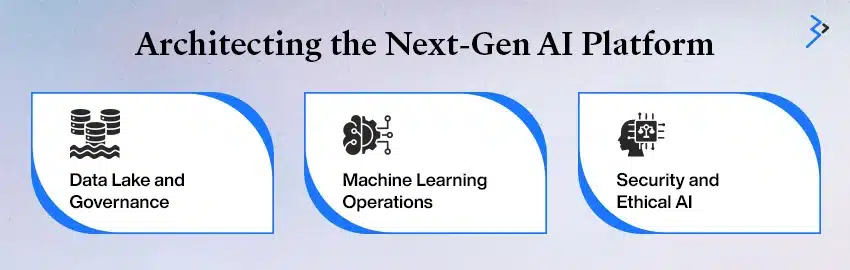

Architecting the Next-Gen AI Platform

Building and deploying effective AI-Driven Fintech Apps requires more than buying software; it demands a robust, scalable, and secure technology foundation. This foundation must support the full data science lifecycle, from ingestion to model deployment.

Data Lake and Governance

The backbone of any effective AI solution is clean, centralized data.

- Unified Data Architecture: A modern data lake architecture, often cloud-based, integrates data from all sources: core banking systems, custom CRM software solutions, transaction logs, and external market feeds. Creating a single source of truth establishes clarity and consistency.

- Data Governance: We must implement strict protocols to ensure data quality, security, and privacy, which are crucial for compliance with GDPR, CCPA, and other regulations. In the financial sector, maintaining data lineage and auditability is non-negotiable.

Machine Learning Operations (MLOps)

MLOps provides standardized practices and tools for deploying and managing ML models in production environments.Many organizations rely on mlops consulting services to help them implement these practices effectively and maintain reliable, scalable model pipelines.

- Continuous Integration/Continuous Delivery (CI/CD): Automated pipelines help quickly and reliably test and launch new or updated AI models, like a new system for detecting fraud. The process ensures that we make changes without interrupting live services.

- Model Monitoring: After deploying the models, monitoring them for drift and bias is crucial, as changing data patterns can lead to a decline in accuracy over time. Ensuring that the models are fair contributes to their effective performance.

Read More – How Metaverse and AI Are Changing The Face Of Digital Transformation

Security and Ethical AI

In the fintech industry, companies must prioritize security and trust. They should deploy AI responsibly.

- Cybersecurity AI: AI is a powerful security tool, capable of identifying and responding to sophisticated cyber threats much faster than traditional firewalls and intrusion detection systems.

- Explainable AI (XAI): Regulators require clarity in high-stakes financial decisions (like loan denial). XAI ensures that humans can understand and audit the logic behind an AI decision.

Strategic Preparation for Deployment of AI-Driven Fintech Apps

The transition to an AI-powered bank requires a cultural and operational overhaul, not just a technical one.

1. Prioritizing Use Cases for Maximum Impact

Avoid the temptation to tackle everything at once. Focus on areas where AI can deliver immediate, measurable Return on Investment (ROI):

- Fraud Detection: Immediate cost savings and risk mitigation are provided.

- Customer Service Automation: Improves CX while reducing call center load.

- Regulatory Compliance: Reduces manual labor and minimizes fines/penalties.

2. Building the Hybrid HR Model

AI will augment, not eliminate, human talent.

- Reskilling the Workforce: Banks should invest in training to transition employees from transactional to analytical roles.

- Creating AI-Human Loops: Design workflows in which AI provides insights while humans apply judgment, such as a credit manager reviewing AI-flagged high-risk loans.

3. The Need for External Expertise

Developing and implementing complex, secure, and compliant AI solutions requires specialized external partners for most institutions.

- Strategic Guidance: External consultants provide a roadmap to integrate AI with legacy core banking systems without causing disruption.

- ML Engineering: Partners bring expertise in building MLOps pipelines and securely deploying models at scale, often a missing skill set in traditional IT departments.

- Regulatory Alignment: Expertise in financial regulations and AI ensures the models are compliant by design, reducing legal risk. Partnering with experienced product teams can accelerate AI adoption while preserving compliance and security. With support for fintech platforms spanning custom software development, mobile apps, QA, AI/data engineering, and UX/UI, institutions can modernize legacy codebases, integrate third‑party APIs, and scale transaction volumes without inflating costs. This collaboration model shortens time-to-market and strengthens post-launch reliability through rigorous testing, observability, and iterative delivery.

Conclusion

Artificial Intelligence is reshaping the digital banking landscape, driving profitability, elevating customer experiences, and strengthening risk management across fintech applications.

To succeed, businesses need organized data, effective machine learning, and a strong commitment to security and ethics. This transition can be complex, but it’s vital for staying competitive.

At Brainvire, we help financial institutions create high-quality, compliant, and scalable platforms to leverage AI strategically. It’s more than just automating processes; it’s about gaining a competitive edge.

FAQs:-

AI-driven fintech apps enhance digital banking by enabling hyper-personalized customer experiences. Automating routine processes by improving fraud detection, enhancing compliance, and lowering operational costs. They let banks modernize legacy systems while delivering faster, more accurate, and more scalable services.

AI uses machine learning to analyze billions of transactions in real time. It detects unusual patterns and flags anomalies with greater accuracy than rule-based systems. Additionally, AI enhances credit scoring and loan underwriting by integrating non-traditional data sources, reducing decision bias, and improving risk prediction.

Key technologies include cloud-based data lakes for centralized data storage and machine learning operations for scalable models. Deployment, robotic process automation (RPA) for workflow efficiency, and cybersecurity AI are also key. Strong data governance and explainable AI (XAI) are essential for assent and trust.

Successful AI adoption prioritizes high-impact use cases, such as fraud detection and regulatory compliance. It’s also crucial to reskill employees for effective AI-human workflows and to seek external expertise for secure integration. Phased implementation and hybrid human-AI decision loops help maintain operational continuity.

Ethical AI assures transparency, fairness, and regulatory compliance in high-stakes financial decisions, like loan approvals. Banks can implement ethical AI by using explainable AI models, monitoring algorithm bias, maintaining data privacy, and aligning AI deployment with legal and regulatory frameworks.

Related Articles

-

Maximizing Employee Engagement with AI-Driven HR Strategies

Did you know the average time to fill a role is 36 days? Among the numerous HR activities, the recruitment process involves multiple layers and is time-consuming. Incorporating AI in employee

-

From Imagination to Automation: Generative AI’s Impact on Creative Workflows

What if inspiration and action occurred in the blink of an eye? A creative team can generate numerous captivating concepts, images, ad copies, and video scripts in one afternoon. This

-

Top 12 AI-driven Testing Tools to Explore in 2025

AI-powered testing tools have revolutionized the software testing process by automating and optimizing various stages of quality assurance (QA). These tools utilize artificial intelligence and machine learning to enhance test