The insurance industry is broad and intricate and faces unique challenges daily. From navigating the intricacies of regulatory compliance to managing customer relationships and processing claims efficiently, insurance companies must trick multiple priorities.

As customer expectations grow, ensuring smooth operations while actively following industry standards becomes increasingly important. These challenges often demand customized solutions, from policy management to tracking and reporting.

In this regard, the use of Odoo ERP stands out. It helps one adopt an integrated approach to managing various operations across multiple industries, such as insurance. The Odoo insurance module integrates everything from policies to premiums to claims and renewals simultaneously.

Odoo ERP helps businesses cut through the complexity and focus on providing top-tier service to their clients by offering automation, real-time data insights, and a user-friendly interface.

In this article, we shall explore how Odoo ERP addresses the unique challenges of the insurance sector. From improving efficiency to enhancing customer satisfaction, we will see how this comprehensive solution reshapes these insurance companies’ operations.

Read More – Modern Restaurant Management Made Simple with Odoo ERP

Overview of Odoo ERP for Insurance Companies

Odoo ERP is an all-in-one business management software module design that allows companies to access needed features. Its flexibility ensures that businesses of any size, including insurance companies, can tailor the system to their unique requirements.

Core Functionalities for the Insurance Sector

- CRM or Customer Relationship Management: Odoo’s CRM helps insurance companies manage customer interactions, track leads, and streamline sales processes.

- Accounting: The integrated accounting module simplifies financial management, enabling insurers to handle invoicing, payments, and financial reporting efficiently.

- Project Management: Odoo Insurance’s project management tools help companies monitor running tasks, deadlines, and workflows related to claims processing or policy management.

- Customer Portals: Odoo for Insurance Companies includes a customer portal. This self-service platform lets clients view policy details, file claims, and interact with insurers.

Why Odoo ERP Stands Out

- Open-Source Model: Odoo is very cost-effective and highly customizable, as it is open-source software. This makes it a great option for insurance businesses looking to avoid the high costs of proprietary software.

- Scalability: Whether a small agency or a large enterprise, Odoo scales smoothly with your business as it grows, thus offering strong solutions to meet evolving needs.

- User-Friendly Interface: Odoo’s intuitive design ensures that users require minimal technical expertise.

Key Challenges in the Insurance Industry

The current insurance industry faces numerous complex challenges that require modern solutions to maintain competitiveness, compliance, and customer satisfaction. This is why some of the problems mentioned below are currently impacting the industry:

1. Complex Claims Management

Claims processing is one of the most important yet challenging aspects of insurance. Speed and accuracy are the key concerns because delays or errors can lead to customer dissatisfaction and financial loss. Key issues include:

- Slow Claims: Processing Insurance companies often face the problem of slow claims processing due to old systems and manual workflows.

- Transparency and Communication: It is important to communicate clearly and openly with policyholders during claims. Lack of transparency may lead to frustration and a loss of trust in the provider.

Solutions: Open-source insurance management software and Insurance ERP software can facilitate claims handling by automating business workflows and communication.

2. Regulatory Compliance

The insurance industry has regulatory requirements with laws and rules that vary by country and geography. Compliance can be demanding in terms of:

- Evolving Laws and Regulations: Changes in insurance laws and regulations make it challenging for companies to stay updated. Failure to abide by these regulations can result in fines and legal hassles.

- Compliance Burden: Managing diverse compliance requirements, ranging from AML to consumer protection laws, is resource-intensive.

Solutions: With Insurance ERP Software with integrated regulatory compliance features, companies can easily update themselves with laws and manage compliance more effectively.

3. Customer Experience and Retention

The various Insurance companies are under pressure to enhance customer experience and retention with the increasing competition. Key challenges include:

- Digital-First Expectations: Customers expect insurance services to be available online with easy-to-use interfaces and fast claim settlements. A poor digital experience can drive them to competitors.

- Personalization: Customers seek personalized insurance products that meet their unique needs. A one-size-fits-all approach no longer works.

- Solutions: Implementing digital tools like open-source insurance management software can help insurers deliver more personalized, efficient, and responsive services that meet customers’ expectations.

4. Data Management and Security

Insurance companies deal with millions of sensitive data, making it a big concern for data management and security. Some of the problems include:

- Data Volume: Dealing with large volumes of data regarding policies, claims, and customer interactions is a significant challenge. Without proper tools, data will become unorganized and difficult to access.

- Data Security and Privacy Risks: As insurance companies contain sensitive information, cyberattacks against them are likely. Therefore, maintaining data protection laws, such as GDPR, and preventing data breaches should become the utmost priority.

Solutions: Strong data protection in Insurance ERP Software will prevent breaches and ensure compliance with privacy laws, allowing their customers to rest easily

Read More – Advantages of Odoo ERP Implementation in Trading Business

How Odoo ERP Solves Insurance Industry Challenges

The insurance industry is a highly dynamic world in which a firm is tasked with meeting many claims, compliant with regulatory bodies, and maintaining strong customer relations. Using a powerful ERP system such as Odoo, an insurance company can look forward to streamlined operations, better customer service, and cost-effectiveness.

Let us see how Odoo ERP overcomes significant insurance business challenges in this section:

1. Streamlined Claims Processing

Claim handling is one of the insurance sector’s critical activities. Odoo ERP provides claims processing by automating the workflow, reducing manual interference, and speeding up claim resolution.

- Workflow Automation: Odoo automates each step of the claims process, from submission to approval, speeding up handling times and improving customer satisfaction. Access to a clear workflow ensures that claims are handled promptly and accurately.

- All-in-One Integration: Odoo smoothly integrates with CRM, email automation, and project management, making claim resolution efficient. This means that claims can be tracked in real-time, and customer queries can be handled immediately through automated emails or notifications. This minimizes delays and enhances the experience for customers and claims handlers.

Read More – The Future of Business Is Here: Artificial Intelligence and Odoo ERP

2. Enhanced Regulatory Compliance

Insurance companies are also regulated. Strict rules must be followed for everything from claim approvals to financial reporting must a. Odoo ERP offers powerful tools to help businesses comply with industry regulations.

- Compliance Tracking: Odoo has built-in features that enable companies to track regulatory requirements and ensure the accurate following of all procedures. This makes it easier for insurance firms to manage across multiple jurisdictions.

- Real-time Reporting and Audit Trails: Odoo offers real-time reporting, which is critical for insurers to comply with regulatory standards. Audit trails and automated reporting allow companies to easily produce necessary inspection or audit documentation. Such transparency helps decrease the likelihood of compliance risks and enhances accountability greatly.

3. Improved Customer Relationship Management (CRM)

For an insurance business, it is through the relationships with customers that ensure success. CRM capabilities help companies efficiently manage customer data, streamline communications, and enhance lead generation.

- Customer Data Management: CRM tools provided by Odoo allow insurance companies to centralize customer information, providing a comprehensive view of each client’s interactions, policies, and claims history. This enables personalized service and quicker responses to customer needs.

- Seamless Communication: Odoo supports automated communication with the help of integrated email and messaging systems. It facilitates one to set up automatic follow-ups and reminders about jobs, ensuring customers always get updates and feel heard.

- Customizable Customer Portals: Odoo allows tailoring of customer portals whereby clients can view their policies, lodge claims, and get updates on their status. This makes it more convenient and enhances the customer experience with a self-service option accessible 24/7.

4. Secure Data Management

One of the most important concerns in an insurance company is data security. This is because an insurance company contains sensitive data related to customers. Odoo ERP offers various features to provide maximum data security.

- Data Backups: Odoo ensures that all insurance data is backed up regularly to avoid loss due to unexpected events. This provides peace of mind to both customers and businesses.

- Access Control: Advanced access control capabilities in Odoo allow access only to authorized personnel to customer data, thereby reducing data breaches and unauthorized access risks.

- Global Security Standards: Odoo ERP adheres to global security standards, including GDPR and all data protection laws in different geographies. This allows insurance companies to act legally and secure customer privacy.

5. Cost and Resource Optimization

Insurance companies often face inefficiencies that cause them to incur high operational costs. Combining different functions into one platform helps businesses reduce inefficiencies and optimize resource allocation.

- Consolidation of Operations: Odoo integrates key functions such as claim management, customer service, and finance into a single platform. This eliminates the need for multiple systems and reduces duplication of efforts.

- Automation for Cost Cutting: Odoo can automate most insurance manual processes, from claim processing to customer communication management. By automating routine tasks, companies can reduce their cost of operations, minimize human error, and improve their return on investment.

Read More – Why Odoo ERP Is The Best Solution For Real Estate Management

Advantages of Using Odoo ERP for Insurance Companies

Odoo ERP offers several advantages to insurance companies, including flexible and affordable solutions that are often explicitly designed according to the industry’s requirements.

Modular and Customizable

Odoo ERP is highly modular, allowing insurance businesses to choose the software modules that best suit their operations. Whether it is claims management, policy underwriting, or customer service, Odoo’s insurance software modules can be customized to specific workflows and improve efficiency.

Affordable Pricing

Odoo ERP provides insurance companies with an affordable alternative to traditional ERP systems. The platform’s cost-effectiveness allows businesses of all sizes to access powerful features without breaking their bank accounts.

Seamless Integration

Odoo ERP is designed to integrate easily with third-party tools and existing systems, ensuring smooth operations across various business functions. Whether integrating accounting software or customer relationship management tools, Odoo can enhance workflow without major disruptions.With Odoo ERP development services, insurance companies can ensure a smooth, scalable, and affordable system that adapts to their changing needs.

Related Articles

-

Modern Restaurant Management Made Simple with Odoo ERP

Summary: In a fast-paced industry where taste and quality are paramount, restaurant and cafe owners must maintain 100% efficiency to stay ahead of nearly 9 million competitors. Also, managing staff

-

Real-Time Logistics Optimization with Odoo ERP Solutions

Summary: Logistics optimization is the backbone of modern supply chain management. It simply refers to streamlining and fine-tuning processes to ensure goods move smoothly from point A to point B

-

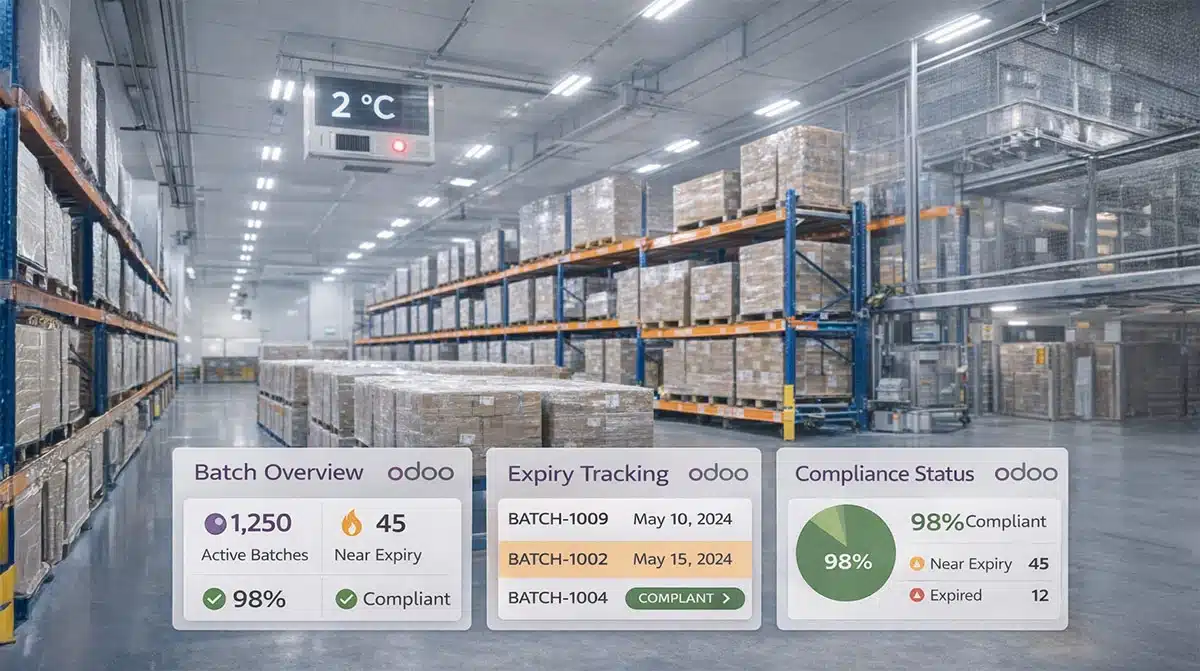

Beyond Expiry Dates Managing Regulated Medical and Pharma Inventory with Odoo

Pharma and medical inventory management has changed. It is no longer just about counting stock or keeping an eye on expiry dates. It is about protecting patient safety, staying compliant