The COVID-19 pandemic has wreaked havoc on the Consumer Goods and Services (CGS) industry, causing it to collapse. Many firms have been thrown off balance by fundamental shifts in customer behavior, supply chains, and routes to market, and only a handful have emerged victorious.

In recent months, consumer behavior has shifted dramatically, permanently altering how, when, and where people purchase products and significantly speeding up the technological shifts that are reshaping the industry. Unfortunately, it is difficult to predict and interpret patterns in such a volatile environment using only conventional benchmarks and historical data to monitor the industry.

The industry's channel and route-to-market (RTM) strategies have been impacted by a more apparent transition toward e-commerce, omnichannel emergence, and the low-touch economy boom through digital payments and contactless deliveries. As a result, organizations must reimagine offerings regularly to keep up with rapidly changing customer demands.

Several leading CGS companies, for example, Pidilite, Nestle, Coca Cola, etc., have quickly gained the ability to handle omnichannel commerce and interaction and forged hyperlocal distribution and retail IT solutions.

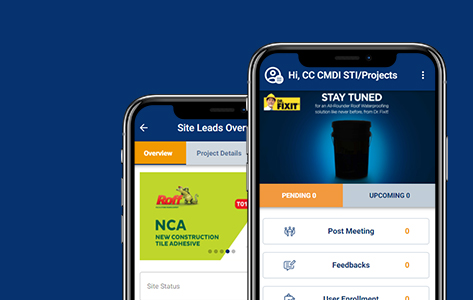

We would like to share our experience of developing a mobile application and website for a prominent consumer goods and services company. The brand provides a series of adhesives, construction chemicals, and polymers.

We created a digital transformation journey that streamlined their internal processes. With this, they now have clarity on transactions with all suppliers, vendors, and customers. In addition, the omnipresence feature allows the brand to make profitable decisions and grab the right business opportunities.

Additionally, resources and investments will need to be continually reallocated, and companies will need healthy ecosystem partners, not just as allies but also as sources of real-time customer data and information.

3 Goals for CGS Companies

1. View Business Through A Consumer Lens: Be Digital; Data and Analytics-driven; and AI-led

As the crisis progresses, consumer behavior is likely to change, making real-time analysis and analytics critical to solving the problem. Businesses must remain close to changing customer demands and develop a deeper understanding of new demand spaces and buying paths as they continue to operate. Ongoing and localized insights are essential to respond to new dynamics and trends while anticipating market shifts. Rethinking the process of innovation will be at the heart of reinvention.

CGS companies must invest in Artificial Intelligence (AI), Machine Learning (ML), and other tools to control customer interactions and evaluate customer habits. This will enable them to provide frontline employees with the information they need to personalize and add value to customer interactions.

For example, an Indian multinational food corporation created a real-time, automated insights engine, leveraging AI and ML across sales and operations. This digital transformation in FMCG helped them enable real-time decision-making and automate their processes.

2. Rethink Channels And Ecosystems: Pivot To The Digital Commerce Wave

Flexibility in business models will be more crucial than ever, and ecosystem partners that allow for innovation and rapid scaling on a variable cost basis will be critical to success. With the transition to omnichannel services likely to be irreversible, a more robust and integrated digital commerce strategy that aligns with new events and customer missions is needed.

Across the e-commerce value chain, decision-support analytics are needed to bolster this. One of the key developments in operating models is the increased use of digital networks to communicate directly with customers. Many fast-moving consumer goods (FMCG) players have co-created products with e-commerce players as online-first products and are getting into last-mile distribution leveraging partner ecosystems.

3. Define A Portfolio Approach For Products And Businesses

During economic downturns, portfolio-minded investment decisions are needed. Businesses will future-proof themselves with an integrated and forward-looking approach to investment allocation and prioritization. Companies will have to realign their key assets and competencies in response to changing market conditions. They may also use modern demand sensing technologies to make better investment decisions.

Many CGS organizations, for example, have shifted their focus to include health and hygiene products and services, such as vegetable wash and immunity-boosting beverages, as well as health supplements and facemasks. Simultaneously, players from the adjacent sector have entered the hand sanitizer market, among others.

The current environment also presents unique opportunities to acquire properties, intellectual property (IP), and talent in the quest for new growth paths. Many long-established industries have been disrupted in recent years by "the rise of the ants" — startups providing services that are cheaper, more transparent, and delivered in novel ways.

EVOLVE for the Consumer

The constantly evolving consumer environment demanded the evolution of a customer's purchasing cycle. In a world where customer data is the new oil, consumer markets are increasingly changing with technology.

In such a dynamic environment, businesses could not afford to ignore any part of the shopper experience or risk falling behind in the market. Consumer experience has become increasingly important in recent years, and brands must continue to evolve and meet modern consumers' changing needs.

Engage for better connectivity: Personalised ads, proximity marketing, and using new technology such as AR, VR, AI, chatbots, and so on are all ways for brands to communicate with their customers, both offline and online.

Consumer’s voice is paramount: Listening to customers' thoughts, suggestions, and reviews is just as essential to provide them with the best products for their needs. For this, brands should use social media platforms, company websites, blogs, newsletters, phone calls and messages, in-store interactions, and other physical and online touchpoints—brands must be omnipresent across mediums to respond to and act on customers' needs.

Organize retail channels to provide a seamless and integrated solution: Multiple distribution channels are the most competitive way to meet customers' expectations in the future. With this, brands can provide a seamless shopping experience—traditional shops, new brick-and-mortar stores, online outlets.

Walk the extra mile to build loyalty: The Key Performance Indicators (KPIs) must be redefined for loyalty assessment. Benchmarking loyalty by conventional parameters becomes extremely difficult in a world where customers have many choices and products to choose from and are not symbolic in the true sense. The brand must go the extra mile to ensure that all its consumers have a memorable experience irrespective of whether any products are bought or not.

Vouch for commitment: Consumers are also constantly assessing a company's dedication to its principles and commitments. As a result, they are more aware than ever before of brands' environmental practices and their effect on the climate. As a result, there is an increasing need for public agencies and brands to cooperate to ensure that sustainability initiatives are incorporated into their operating practices as a standard.

Enhance product and service offering: While brands must use technology to connect with customers more, consumer experiences must also be improved through hyper-personalized products, bespoke marketing and loyalty strategies, agile and lean business models, and so on. Another significant development is the need for vernacular content to meet consumer needs—many brands are now providing their services in non-English regional languages to meet the demands of both urban and non-urban customers.

Gearing Up For The Future

Businesses must now, more than ever, consider how they can navigate today's volatility by preparing for the future. Leaders are thinking increasingly about disruption and strategizing to make their businesses more resilient and efficient to place their companies for long-term success in the recovery. As CGS organizations think of the more distant future, three key areas should be considered.

1. Build Business Resilience: Create Next-gen Agility In Operations

Company flexibility and the ability to adjust to changing circumstances quickly are critical in these unpredictable times. Companies in India must increase their strategic ambition, gain capabilities that differentiate them and make growth better when others are cutting back and recovering at different rates.

Supply chains have traditionally been built for productivity. They must now redesign them to strike a balance between performance and durability. CGS businesses must have purpose-driven intelligent supply chains that work quickly and with greater agility to power future development.

2. Workforce Of The Future: Create Shared Workforce Resilience

Since COVID-19, the types of skills and positions required by CGS organizations have changed, and the way they can source these roles is becoming more innovative and agile. Talent and its procurement would become increasingly geographically agnostic, offering both employers and employees more options.

The idea of a "workforce" would extend beyond conventional organizational borders, with the movement toward increased automation and contactless and digitally controlled processes adding to this. Employers will increasingly embrace and follow this "on-tap" job model, as they realize that fixed costs must be made more variable.

3. Commit To An Elastic Cost Structure: Create Fuel For Growth

CGS organizations must analyze investments holistically when making temporary cuts, balancing the trade-offs between near-term realities and longer-term considerations.

To allow elastic cost structures, CGS organizations must reset the cost baseline for the new reality, improve the effectiveness of zero-based cost strategies, and incorporate and maintain a broader culture of cost ownership.

Reducing stock-keeping unit (SKU) complexity to streamline cash management; variabilizing costs, including technology (e.g., software-as-a-service and cloud), and outsourcing non-core activities, while investing in greater data intelligence can help better adjust cost structures and manage liquidity.

Stay Connected to Technology. Stay Connected to Customers.

The following solutions can help adjust cost structures and manage liquidity for your business:

- Reduced stock-keeping unit (SKU) complexity can streamline cash management

- IT cost variabilization including technology (e.g., software-as-a-service and cloud)

- Outsourcing non-core activities while investing in greater data intelligence

KONNECTED to the Consumer

Consumers' interconnectedness—the key point was that the internet and technology are driving consumers' interconnectedness between themselves and with brands. Therefore, it was important for brands to be "linked" to their consumers/shoppers to win them.

K- Knowledge of consumer data and insights

Brands use “big” data generated by digital/online and through technologies in various ways to improve the customer retail journey and experience. Brands will benefit from the information gained from this valuable consumer data in terms of customized targeting, personalized offers, and a more "meaningful" dialogue with their customers.

O- Omni-channel approach unlocking the prospects

The merging of offline and online retail modes has given rise to omnichannel retail, in which customers can search online and buy offline, or vice versa. As a result, major brands have begun to transition into either pure-play offline or pure-play online mode or a hybrid of the two.

N- National policies impelling business growth and benefitting consumers

Increased investments have resulted from favorable policies, which help the country develop economically and aid in the construction of infrastructure, the introduction of new technology, the development of significant social and environmental effects, and so on.

N- Novelty attracting the new-age shoppers

Although affordability and convenience continue to be the most important factors in influencing a customer's purchasing decision, innovation or uniqueness in the product or service often drives sales. Brands' innovative approach to offering benefits by digital channels also aids brands in engaging with their customers and fostering loyalty.

E- Environment and social practices driving sustainability and influencing consumer behavior

Sustainable practices will assist brands in standing out and gaining consumer confidence. Sustainable procurement, greenhouse gas mitigation, waste management, clean packaging, natural and organic food choices, and other sustainable practices are gaining popularity.

C- Convenience bridging the gaps

Companies are being pushed to enhance their last-mile distribution to make it easier for consumers and customers to access goods as their needs increase. Hyperlocal start-ups, which connect local customers and stores to reach remote areas, are a result of this compelling need for convenience and having the product “now.”

T- Technology augmenting consumer experience

Factors such as improved digital infrastructure, smartphone use, and an increase in the number of technology start-ups assist in adopting and introducing new technologies for commercial retail, especially in the evolved general trade.

E- E-wallets scaling up the payment ecosystem and handiness

The exponential growth of Unified Payment Instruments (UPI), especially m-wallets, has been fueled by increased convenience, increased internet penetration, increased smartphone use, and government support.

D- Digital marketing as a growth engine

The rapid growth of digital marketing in India is expected to be fueled by benefits such as cost-effectiveness, customer engagement, and personalized offerings. Native marketing, a non-intrusive ad format, will be used in India in the future to make consumers' advertising experiences wholly normal and in sync with their retail journey.

Conclusion

Innovation will be more critical than ever as we move toward the next normal amid changing consumer needs and occasions. As a result, companies should reconsider their innovation strategies to meet specific needs better and propel development.

Brainvire has worked with top organizations in the retail industry and has provided them a steady platform to adopt digital transformation through retail IT solutions and deliver enhanced customer experience.

Related Articles

Digital Transformation

Predictive Analytics for E-commerce Apps: How AI Anticipates Customer Needs & Boosts Sales

Digital Transformation

AI in Action: Revolutionizing Content Management and Delivery with Adobe Experience Manager Assets

Digital Transformation

Beyond the Launchpad: Why Dedicated Post-Migration Support is Your Shopify Success Secret Weapon