Delving into mobile solution details, the year of 2016 has established base for improvement in adopting mobile resolution. The usage of web and application, advanced featured devices, and mutual approach towards mechanized management have made many things achievable. Industries are going in the path of digitalization and creating marvel milestones in this journey.

Over the recent years, a majority of changes are attributed in the expansion in form of IT solutions that have shaped a different terminology in every industry. Yes, one thing is for sure that mobile technology is defining the future.

Well, this is the time when entrepreneurs and business owners are drastically moving towards maximum usage of mobility, healthcare and banking industries will be leading with the digitalization as never before. Healthcare industry is administrated to provide finely tuned and dogmatic services that cover a whole concern for patients and its health issue. On the other hand, banking industry is making influential changes implementing mobile operative accounts and digital payments.

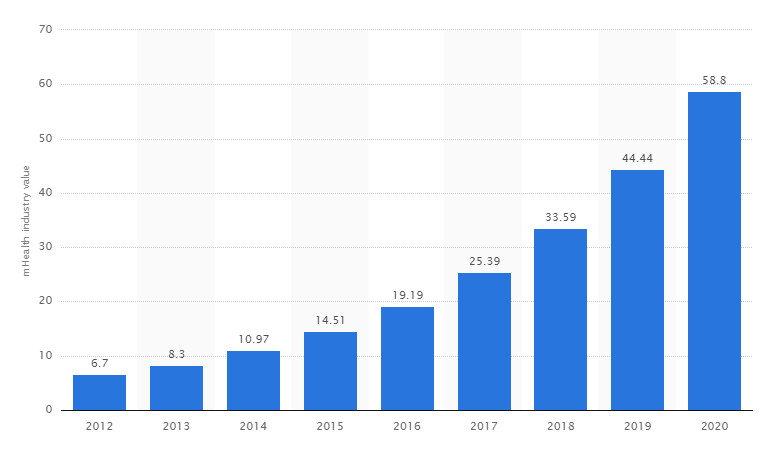

The below statistics can show an incremental technology adoption in health care industry:

The estimation regarding the worth of the global mHealth market is to be at approx 25.39 billion US dollars in the year of 2017. And it will approximately reach at 58.8 billion by 2020, indicates the statista report.

global mHealth market revenue (US dollars) Credit: Statista

People are becoming more aware towards health and fitness issue and application usage of mobile apps for the same is increasing rapidly. Mobile apps are driving the way of healthcare industry with efficiency and accuracy. It is being said that, 50% of smartphone users will have downloaded mobile health apps by 2017. The banking and healthcare industries are taking on mobile solution to provide quick services, personalization for users, keep track of user’s activities and so on. Where the majority of industries have already acquired mobile solutions, banking industry is leading with more consumption of mobile apps for their users.

Mobility investment in banking sector is rising and forecast to surpass $100 billion by 2020. Professional services, personalized experience and complete track of activities these are the objectives fulfilled by bank industry through the consumer connectivity through mobile apps. From overall perspective banking and healthcare industries are leading with the mobility solution to cater the primarily objectives of consumers.

Well, revenue generation would increase accomplishing the fundamental factors. With the help of hardware purchases and software acquisition through mobile apps, mobile application development for the enterprises would gain strongest growth by the time.

Mobile banking is the mainstream nowadays among the users. The robust authenticity, direct deposits, debit/credit card integrations, loans and withdrawals, prompt money transfer are helping customers to make most of mobile banking apps. Mobile banking transactions are now delivering the range of services in a much secured manner. E-commerce, retail transactions, and online services providers are equipped with mobile solutions.

Industrialist restrained the core factors such as products or services in mobile apps to attain the customers around. Moreover, here is list of statistics that proved comprehensive use of mobile solutions in banking as well as in healthcare industry.

Mobile investments in healthcare:

80% of physicians using smartphones and medical apps to stay connected with their patients.

93% of physicians believe that mobile health apps can improve patient’s health.

93% of physicians find value having a mobile health connected to emergency health problems.

52% of smartphone users gain health related information on their phones.

The global healthcare solution market is expected to witness exponential increment growth in the near future that is growing at a rate of 33.4% during the forecast time.

Mobile investments in banking:

According to one study on customer experience Clarabridge, 36% of banking customers haven’t visited a branch in past few months in the USA.

Another in year of 2016, Federal Reserve reported that 67 percent of millennials now use mobile banking, compared to 18 percent of consumers age 60 or over.

More and more bank branches are shutting down in the past year as mobile banking app itself provides an entire banking transactions on hands.

As the retail and ecommerce keeping their feet into the ground, mobile banking and payment integrations with banks are the imminent factors to aid in digital mode of payments.

According to a Salesforce research, 75% of millennials are somewhat dependent on mobile banking app to interact with their bank for transactions such as paying bills, transfer fund and depositing a check, and inquire about balance.

The overall matter of mobility solution in banking as well as in the healthcare industry would keep their perspectives to provide automated yet wide-ranging way of services. Mobile application development will continue to grow as there is increasing number of mobile devices day-by-day.

Mobile Application development: calling it as a future

Indeed, a mobile is the future. Seeing and observing aforementioned statistics one can ensured the mobile driven way of work that that can guarantee the personalized experience. Mobile apps are coming at the center position in every industry to keep customer service at its best. Embracing the technology and mobile era banking and healthcare industry are at first position that contributes major role in revenues. Meeting the mobility needs and on-hand customer experience will be the next future strategy in every industry.