About

The client is a leading Philippines financial services provider who believes in utilizing technology to its best to prioritize customer service. Their clientele includes BPOs that cater to the global market and corporations that leverage technology for growth and strive for progress, essentially, enterprises with demanding system requirements. They deliver whatever their clients imagine. Therefore, they wanted a software solution to streamline and enhance the KYC (Know Your Customer) verification process for businesses and organizations.

Project Highlights

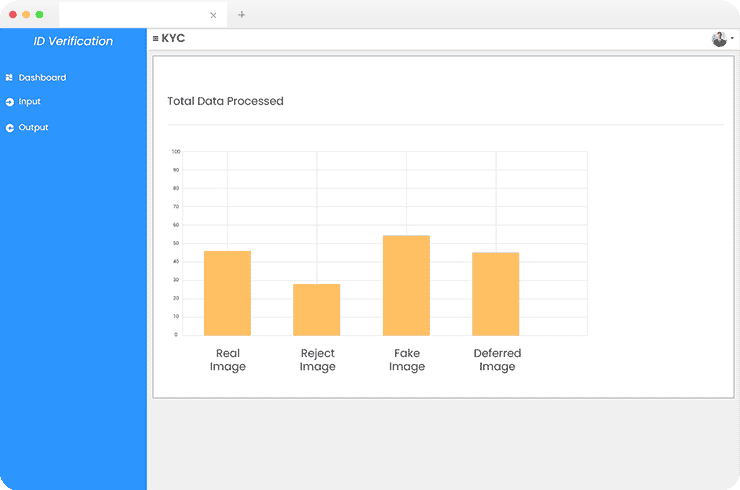

The KYC Verification Platform is an innovative software solution designed to streamline and enhance the KYC verification process for businesses. It leverages the power of TensorFlow, OpenCV, PyTorch, NumPy, and Faster R-CNN to streamline the KYC process while maintaining data accuracy and security. The platform automates extracting and validating critical information from KYC documents provided by clients, leading to increased efficiency, accuracy, and data security in the KYC process.

The Challenges

- Varying Image Quality and Alignment:Images from different devices and various angles may have varying quality and misalignment.

- Time Consuming and Expensiv:Collecting and annotating the KYC documents dataset is crucial but time-consuming and expensive.

- Preprocessing Data:Preprocessing data to match the input requirements of the Faster R-CNN model can be intricate.

- Complex Extraction and Verification:Non-standard characters in names and ID numbers make extraction and verification complex.

Tech Stack

Python

Jira

AWS

Django

Azure DevOps

TensorFlow

Open CV

Result

Improved Image Clarity and Reduced Distractions

The Non-Local Means Denoising algorithm effectively reduced random noise while preserving important image details. The KYC Verification System enhanced the accuracy of subsequent image processing steps, such as feature detection, character recognition, and object localization.Accurate Recognition of the Regions of Interest

Creating a comprehensive dataset by collaborating with financial institutions and document providers resulted in an improved model that accurately recognizes regions of interest on various KYC documents. It reduced the manual annotation burden and enabled the model to effectively generalize across different document types, layouts, languages, and qualities.Efficient Workflow and Automated Handling

Reusable scripts and automated handling saved time and effort by streamlining the data preprocessing process and simplifying image preparation. Additionally, utilizing pre-trained region proposal networks speeds up the process of generating region proposals and enhances accuracy.Consistent and Clean Text

Regular expression utilization identified and eliminated special characters, accents, and non-standard characters, ensuring consistent and standardized text. It also simplified text comparison by removing variations introduced by special characters.