Table of contents

The Evolution from Personalization to Hyper-Personalization

Why Hyper-Personalization Matters in Banking

Real-Life Example: How DBS Bank Uses Hyper-Personalization

The Power of Adobe Experience Cloud in Hyper-Personalized Banking

Key Elements for Successful Hyper-Personalized Banking

Real-Life Example: Bank of America’s Erica

Hyper-Personalization: Beyond Marketing to Service & Support

Overcoming Challenges in Hyper-Personalization

Future Trends: Where is Hyper-Personalized Banking Headed?

Real-Life Example: ING’s Personalized Financial Coach

Key Takeaways: Hyper-Personalized Banking with Adobe Experience Cloud

Hyper-Personalized Banking: Future of Customer Engagement

FAQs

Imagine walking into a bank where every interaction feels uniquely crafted, almost as if there’s a dedicated advisor who truly understands financial goals, spending habits, and life aspirations. No more generic emails promoting irrelevant loans, no credit card offers that don’t fit lifestyle needs, and certainly no cold calls disrupting a busy day. Instead, banking becomes effortless, with timely and meaningful communication that aligns seamlessly with everyday life.

This isn’t just a futuristic vision. Hyper-personalization in banking is becoming a powerful reality, driven by AI-powered platforms like Adobe Experience Cloud. By integrating real-time data, predictive analytics, and behavioural insights, banks are transforming how they engage with customers, creating experiences that feel deeply personal and relevant.

Today’s banking leaders are no longer simply service providers; they’re becoming trusted financial partners who anticipate needs, simplify decisions, and enhance financial wellness. Hyper-personalization is at the heart of this evolution, enabling banks to connect emotionally, build loyalty, and deliver value that goes beyond transactions.

Let’s explore how hyper-personalized banking is redefining customer loyalty and engagement – and uncover how innovative banks are using AI-powered Adobe experiences manager to build stronger, lasting relationships in the digital era.

The Evolution from Personalization to Hyper-Personalization

Personalization in banking started with simple gestures: addressing customers by name in emails or greeting them on birthdays. While these efforts showed thoughtfulness, they remained surface-level.

Hyper-personalization, on the other hand, goes far beyond. It integrates real-time data, AI, and behavioural analytics to craft experiences so unique that customers feel banks are conversing directly with them.

Here’s a relatable example:

When logging into a banking app to check balances, instead of seeing standard product ads, imagine receiving a notification saying, “It seems travel is on the cards this summer. Did you know the Platinum Travel Card offers 5% cashback on all international spends?”

This message reflects:

- Awareness of recent travel-related purchases

- Contextual offer matching lifestyle goals

- Timely and relevant engagement

That’s hyper-personalization in action.

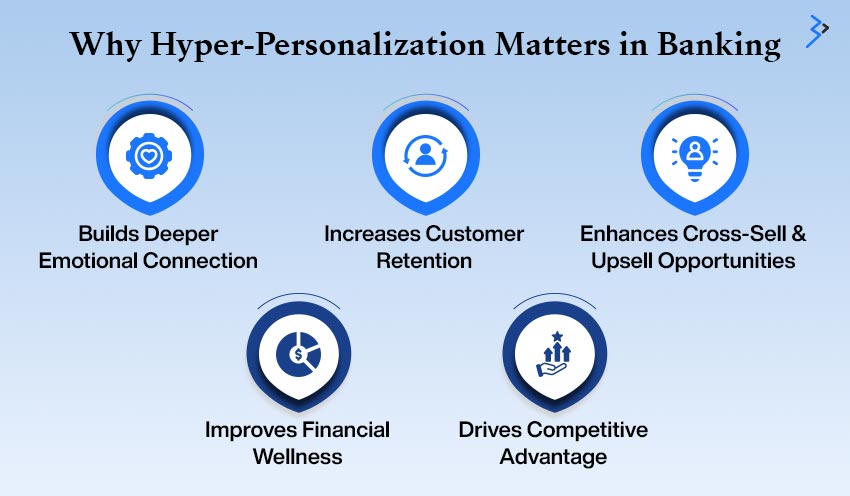

Why Hyper-Personalization Matters in Banking

Today’s customers are digitally savvy and expect their bank to truly understand them. According to an Accenture report, 91% of consumers prefer brands that offer relevant recommendations and offers. Banking is no different. Hyper-personalization has become essential because it delivers value that goes beyond simple transactions.

Here’s why hyper-personalization is transforming banking:

- Builds Deeper Emotional Connection: Customers feel understood and valued when interactions reflect their life stage, spending habits, and aspirations.

- Increases Customer Retention: Personalized offers, proactive financial advice, and tailored experiences make switching banks less attractive.

- Enhances Cross-Sell & Upsell Opportunities: Relevant recommendations encourage customers to explore more services without feeling overwhelmed or pushed.

- Improves Financial Wellness: Hyper-personalization enables banks to nudge customers towards smarter savings, investments, and spending decisions based on behavioural insights.

- Drives Competitive Advantage: Banks leveraging AI-powered personalization stand out in a crowded market by delivering timely, meaningful, and impactful customer experiences.

Hyper-personalization isn’t just a strategy; it’s the future of banking, ensuring every interaction builds trust and loyalty in an increasingly digital world.

Real-Life Example: How DBS Bank Uses Hyper-Personalization

DBS Bank, one of Asia’s leading financial institutions, leveraged AI and Adobe Experience Cloud to build hyper-personalized experiences. The bank uses data from various sources – transactions, app interactions, and customer service touchpoints – to create unique customer journeys.

For instance, if a customer frequently spends on dining out, DBS sends personalized restaurant offers or curated credit card deals that enhance dining experiences. Similarly, if an upcoming payment is detected, timely reminders with a direct payment link ensure convenience.

As a result, DBS observed:

- 40% increase in digital engagement

- Significant growth in credit card spend per user

- Improved customer satisfaction scores across digital touchpoints

This showcases how strategic hyper-personalization isn’t just about selling more – it’s about enhancing customer value in daily life.

The Power of Adobe Experience Cloud in Hyper-Personalized Banking

Adobe Experience Cloud is transforming how banks connect with customers by combining data intelligence with creative tools to deliver hyper-personalized experiences that truly resonate. Here’s how it empowers banks:

- Real-Time Customer Profiles: Builds unified profiles using data from transactions, website behaviour, app usage, and service interactions, creating a 360-degree view of each customer.

- AI-Powered Insights with Adobe Sensei: Analyses data to predict customer needs and behaviours, enabling banks to engage proactively with relevant offers, tips, or reminders.

- Dynamic Content Delivery: Ensures customers receive tailored messaging, whether via emails, app notifications, or website banners, matching their preferences, activities, and goals.

- Omnichannel Orchestration: Delivers consistent, seamless experiences across mobile apps development services, internet banking, ATMs, and even physical branches, ensuring customers feel valued wherever they interact.

By integrating these capabilities, Adobe Experience Cloud helps banks move beyond generic marketing to create meaningful, personalized journeys that build trust, deepen relationships, and drive customer loyalty in a competitive digital banking landscape.

Example: Personalized Loan Offers Using Adobe

Let’s say a customer searches for home loan options on a bank’s website but drops off midway. Using Adobe’s AI-powered journey orchestration, the bank sends a follow-up email within hours:

"Saw you were exploring home loans. Here’s a personalized rate based on your existing relationship with us. Planning to buy a new home soon? Let’s make it easier together."

This approach combines:

- Behavioural triggers (website visit and drop-off)

- Predictive modelling (eligibility and custom rates)

- Emotional messaging (supportive tone to ease decision-making)

Such hyper-personalized nudges result in higher loan conversion rates while reinforcing brand trust.

Read More - Driving B2B Sales & Marketing Alignment with Adobe Experience Cloud

Key Elements for Successful Hyper-Personalized Banking

Hyper-personalization isn’t a simple plug-and-play strategy. It requires robust systems, intelligent analytics, creative content personalization, and seamless orchestration. Here are the core elements that enable banks to deliver hyper-personalized experiences that drive loyalty and customer satisfaction:

1. Unified Customer Data Platform (CDP)

A strong foundation of hyper-personalization lies in having a Unified Customer Data Platform (CDP). Banks deal with vast amounts of data spread across silos: savings accounts, credit cards, home loans, personal loans, investment portfolios, insurance policies, and customer service interactions.

A CDP integrates this scattered data into one cohesive, real-time profile of each customer. This 360-degree view ensures AI models and marketing teams have accurate, updated insights to personalize experiences meaningfully.

Example in action:

If data shows that a customer recently paid university tuition fees, the bank can:

- Offer tailored student loan top-ups

- Provide budgeting tools for managing education expenses

- Suggest an education-linked recurring deposit for future semesters

These proactive and contextual solutions make customers feel understood and supported in their life goals, fostering long-term loyalty.

2. AI-Driven Predictive Analytics

Data alone isn’t enough. It’s the AI-driven predictive analytics that converts data into actionable insights. Banks use AI models to analyze spending patterns, life events, credit behaviour, and even browsing activities to predict upcoming needs with precision.

Real-life examples include:

- Nursery purchases spike - A surge in nursery furniture or baby product purchases might indicate an upcoming childbirth. AI models detect these patterns and trigger offers for child insurance plans, family health policies, or junior savings accounts.

- Frequent high-value eCommerce purchases - Customers consistently making large online purchases could be ideal candidates for premium credit cards with higher limits, better cashback, and exclusive rewards. Such recommendations aren’t generic upsells; they match spending behaviours, increasing acceptance rates.

Predictive analytics ensures banks move from reactive product marketing to proactive financial guidance, strengthening customer trust and engagement.

3. Dynamic Content Personalization

Hyper-personalization extends beyond offers and products. It’s about delivering content that matches individual interests, goals, and life stages. Dynamic content personalization tailors in-app banners, emails, blog recommendations, and push notifications for maximum relevance.

For example:

- A customer actively investing in mutual funds and stocks should see:

- Market insights curated for their portfolio mix

- Investment tips and economic updates tailored to the sectors they invest in

- A millennial saving for travel sees:

- Goal-based budgeting guides

- Savings calculator tools for upcoming trips

- Exclusive travel offers with partner brands

This type of personalization creates an experience where customers feel their bank isn’t just selling products – it’s acting as a financial advisor invested in their success.

4. Omnichannel Consistency

Imagine receiving an email offering an exclusive credit card upgrade, only to visit the bank branch and hear that no such offer exists. Experiences like these erode trust instantly.

Omnichannel consistency ensures that every customer touchpoint – whether the mobile banking app, website, call centre, chatbot, or physical branch – communicates the same personalized message.

Here’s how it works with Adobe Experience Cloud:

- A customer browsing home loan calculators on the website sees related mortgage offers when logging into the app later.

- The same offers are visible to relationship managers in-branch, who can continue the conversation seamlessly without the customer needing to repeat their requirements.

This consistency builds confidence and trust. Customers feel valued, knowing their bank understands them at every interaction without disconnects or repetitive verifications.

Bringing it all together

Hyper-personalized banking isn’t just a tech upgrade – it’s a cultural shift towards customer-first thinking. Combining:

- A unified data platform

- AI-driven predictive analytics

- Dynamic, context-rich content

- Seamless omnichannel delivery

enables banks to transform from mere service providers to trusted financial partners, deeply embedded in their customers’ daily lives and life goals.

Banks adopting these key elements are not just driving conversions; they are building emotional connections that fuel long-term loyalty and advocacy in today’s competitive digital banking landscape.

Real-Life Example: Bank of America’s Erica

Bank of America introduced Erica, an AI-powered virtual assistant that offers hyper-personalized banking support. Erica provides:

- Proactive bill reminders

- Personalized insights on spending patterns

- Tailored financial advice based on recent transactions

If grocery expenses spike suddenly, Erica may suggest budgeting recommendations or flag suspicious transactions for security. This conversational banking experience has driven customer loyalty and positioned BoA as an innovator in digital banking.

Hyper-Personalization: Beyond Marketing to Service & Support

Personalization isn’t limited to sales and marketing alone. Banks using Adobe Experience Cloud integrate personalization into customer support too.

For example:

A customer raising a query about international transactions is routed to a support agent with access to their recent travel spends, forex card usage, and travel insurance coverage. The agent resolves the query efficiently without needing multiple verifications.

Such seamless support interactions build customer confidence and loyalty.

Overcoming Challenges in Hyper-Personalization

While the benefits are immense, hyper-personalization also poses challenges:

- Data Privacy Concerns: Customers value personalization but are wary of how data is used. Transparency and opt-in controls are essential.

- Siloed Data: Fragmented systems hinder unified views. Integrating data across banking products and departments remains a priority.

- Legacy Systems: Many banks still operate on outdated systems that limit real-time data availability and AI integration.

- Change Management: Teams must shift from traditional campaign-based marketing to real-time, data-driven customer engagement strategies.

Banks adopting Adobe Experience Cloud often begin with pilot personalization journeys, measure impact, and gradually scale to full hyper-personalization maturity.

Read More - From Chaos to Clarity: Optimizing Marketing Operations with Adobe Workfront and AI

Future Trends: Where is Hyper-Personalized Banking Headed?

| Future Trend | Description |

| Voice-Activated Banking Personalization | As voice banking grows, AI will enable personalized financial conversations through virtual assistants and smart devices. |

| Behavioural Biometrics | Security and personalization will combine, with biometrics enabling seamless authentication and unique personalized experiences. |

| Contextual AI Nudges | Banking apps will provide micro-recommendations integrated with daily life, from reminders to split bills after dining out to suggesting investment top-ups on salary credits. |

| Emotional AI | AI models will analyse tone and language in customer queries to adapt responses accordingly, enhancing empathy in digital interactions. |

Real-Life Example: ING’s Personalized Financial Coach

ING Bank launched a digital financial coach integrated into its banking app, leveraging AI to provide hyper-personalized financial health recommendations. Users receive:

- Alerts on overspending compared to monthly averages

- Suggestions to move idle funds into higher-yield savings accounts

- Reminders for upcoming large payments based on past patterns

Such proactive nudges empower customers to manage their finances better, fostering loyalty rooted in trust and financial wellness.

Read More - Unlocking Operational Insights with an AI Assistant in Adobe Experience Platform

Key Takeaways: Hyper-Personalized Banking with Adobe Experience Cloud

- Customers expect banks to know them deeply and serve them contextually.

- Hyper-personalization builds emotional connection, loyalty, and cross-sell opportunities.

- Adobe Experience Cloud enables real-time, AI-driven personalized experiences across channels.

- Leading banks like DBS, Bank of America, and ING are reaping tangible business results.

- The future lies in conversational, behavioural, and emotionally intelligent hyper-personalized banking.

Hyper-Personalized Banking: Future of Customer Engagement

As banking rapidly shifts to a digital-first world, hyper-personalization is no longer a nice-to-have strategy – it’s the very foundation of meaningful customer engagement. Generic mass messaging simply doesn’t resonate in an era where customers expect every interaction to be relevant, timely, and deeply empathetic.

Banks that continue relying on one-size-fits-all approaches will struggle to keep pace with competitors embracing personalization powered by AI and real-time data. Platforms like Adobe Experience Cloud empower banks to build these seamless, hyper-personalized journeys with precision. By unifying customer data, leveraging AI insights, and delivering dynamic, contextual content across every touchpoint, banks can transform their role from mere financial service providers to trusted partners in their customers’ lives.

Customers may not remember each transaction detail, but they always remember how their bank made them feel – whether it was being guided towards smart investments, receiving proactive budgeting tips, or simply feeling understood during important life moments.

That’s the true power of hyper-personalized banking: creating experiences that make customers feel supported, valued, and confident in every financial decision, building loyalty that lasts far beyond products and services.

FAQs

1) What is hyper-personalization in banking?

Hyper-personalization uses real-time data, AI, and behavioural insights to deliver tailored banking experiences, offers, and content that match each customer’s unique needs and life goals.

2) How does Adobe Experience Cloud support banks?

Adobe Experience Cloud helps banks unify customer data, analyze behaviours with AI, and deliver dynamic, relevant content across all touchpoints to create seamless, personalized customer journeys.

3) Why is hyper-personalization important for banks today?

Customers expect relevance, empathy, and proactivity. Hyper-personalization builds loyalty, drives engagement, and positions banks as trusted financial partners rather than just service providers.

4) What are some real-life examples of hyper-personalization?

Examples include personalized credit card upgrade offers based on spending patterns, tailored investment tips for wealth management users, and proactive child insurance suggestions after nursery purchases.

5) Does hyper-personalization compromise customer data privacy?

No. Leading banks prioritize transparency and consent, ensuring customer data is securely used only to enhance personalized experiences while complying with all privacy regulations.

Related Articles

Digital Transformation

Orchestrating Seamless Customer Journeys: The Power of Adobe Journey Optimizer (AJO) in Real-Time