About Project

The client is a prominent financial services and loan company in the Asia-Pacific region. They offer a diverse range of services from loans, mutual funds, and financial services to a reputed clientele. The client wanted a loan app to help customers manage their financial activities and expenses without visiting the firm.

Mobile

Platform/OSFinance

Category

Brief

Highlights

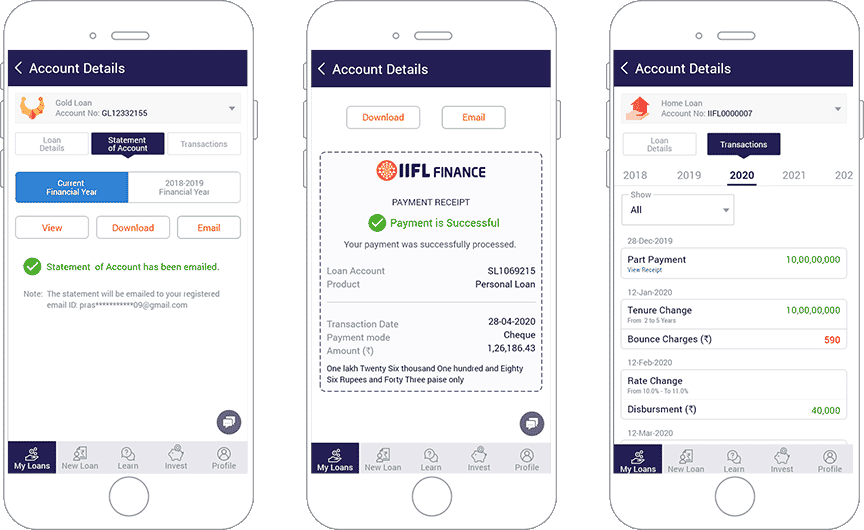

Due to the COVID-19 pandemic, customers were unable to visit financial service offices. The app supplied them with updated information related to loans and funds. The redesigned app provides a better customer experience and automates financial activities. The app has helped to reduce footfall to the office by 68% and currently has 5 million active users.

Case StudyFeatures

Biometric authentication- The mobile app offers secured and tight access to users to maintain data security. It has fingerprint-based access, facial recognition, and a mPin service as well.

Transforming customers’ journey- We’ve redesigned the app to augment customer experience. It covers all touchpoints for customer interactions to retain and grow clients.

Secure transactions- Since loan amounts can vary, the app has been integrated with a secure and safe payment gateway to maintain the financial security of users.

CIBIL score identification- The app is also integrated with several third-party solutions for user authentication and provides them with a CIBIL score.

Tech Stack

Android

IOS

AI/ML