About

IIFL is a renowned Indian financial institution and one of the largest in the Asia-Pacific region, offers loans, mutual funds, investments, and other financial services.

Financial Services Provider

BusinessAsia-Pacific

Location

Seeking to integrate advanced technology into a mobile app, they approached Brainvire for mobile app development services. The goal was to create an app enabling customers to track their wealth and investments seamlessly.

Brief

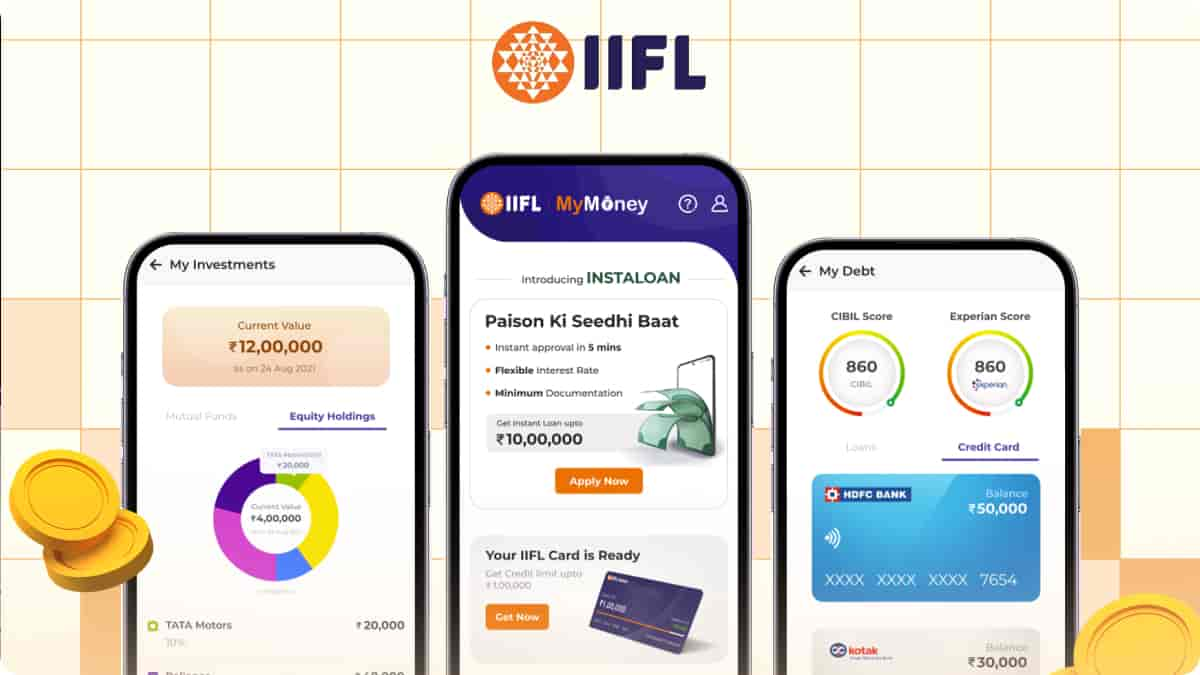

Our skilled mobile banking app development team designed an innovative wealth management app, enabling users to manage their income, expenses, and investments directly from their mobile devices.

List of Services Offered

- Developed AI-driven mobile app

- Enabled intelligent financial tracking

- Personalized investment recommendations

- Facilitated seamless portfolio management

Enhanced UI/UX Experience

Features

Developed a Solution with Intelligent Transaction Identification Capabilities

The mobile app we developed supports AI/ML algorithms that can read text messages and identify any transactions. It then provides comprehensive details such as income, expenses, payee information, amounts, and purpose, offering users a clear financial overview.

Facilitated Seamless Mutual Fund Investment Tracking

We enabled users to manage all their mutual fund investments with just a few clicks. Our solution identifies investments from consolidated statements, eliminating the need for manual data entry and providing a seamless investment tracking experience.

Provided Data-Driven Mutual Fund Recommendations

Our team incorporated a data analytics feature to recommend lucrative investment options to users. It analyzes their current investments and provides suggestions tailored to their portfolios, aiming to yield higher returns on investment (ROI).

Enabled Intelligent Income and Expense Categorization

Leveraging machine learning, the mobile app we developed collects and analyzes a large volume of data. Our AI/ML algorithms intelligently categorize income and expenses, enabling accurate and automated data segregation for comprehensive financial insights.

Technology Stack

Machine Learning

AI/ML

Mobile Operating System

AI/ML

Social Section

What Our Client Says!

Similar Projects!

Unlock the Power of AI-Driven Financial Management

Embrace the future of intelligent financial management and contact Brainvire today!